Travelling (or backpacking) for a long period of time usually means that you need to budget your money. Unless you’re very well off then you only have a limited amount of funds so it’s important to spend them well!

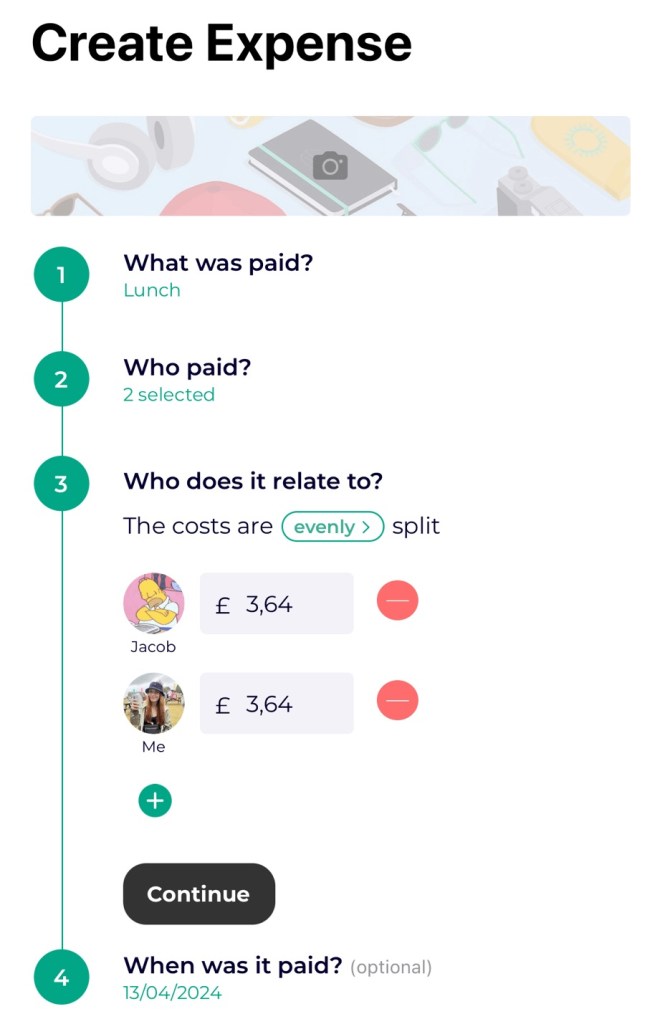

An essential tool that we have used for budgeting is the app, Lambus. This app is great for organising your travel itinerary but it also allows you to record your expenses.

On Lambus you’re able to split the expenses with the person you’re travelling with, and you’re also able to select the category for each expense.

Budget categories-

We have three different categories for our expenses. They are general (daily expenses), fees, and accommodation.

‘General’ is our daily expenses. We have had a £25 budget between us each day in South East Asia. This is spent on things such as meals, drinks, snacks, motorbike rental, and cheap activities. Depending on where we are depends on how much we spend in a day. In countries that are cheaper, such as Vietnam, we spent under our daily budget quite often. Other countries, such as Thailand and the Philippines, cost a little more so we would be over budget more often than not.

Fees include things such as transport (buses, flights, long taxi journeys etc), more expensive activities, visas, and SIM cards.

Accommodation is pretty self explanatory in that it covers all of our accommodation. We have a budget of £25 per night between us for our accommodation. Whilst travelling South East Asia we have only gone over budget a handful of times in places such as Bangkok. We try to aim for around £15 a night is possible and have found some lovely accommodation for this price.

How do we separate the different pots of money-

We have three categories for our expenses so we use three different bank accounts to reflect this.

Our general daily expenses are in a joint Starling account that we can both access at any time. Travelling in South East Asia means we mainly use cash but if we can we will pay on card out of our joint account.

The accommodation expenses come out of my Monzo account. Where possible we try to pay online using card when we book the accommodation. This helps to reduce the amount of cash we need to withdraw and minimises the ATM fees. Sometimes it’s unavoidable and we have to pay with cash.

The expenses for fees come out of my Revolut account. Again where possible we try to pay online using card (e.g. when booking transport on the 12Go website or paying on card on the Grab app) but this isn’t always possible.

The reason that accommodation and fee expenses come out of my personal account rather than a joint is simply because we didn’t think to set up other joint accounts. My advice would be to set up several joint accounts if you’re travelling with a partner, but obviously everyone manages their finances differently.

There isn’t any real reason that we use my personal accounts rather than Jacob’s accounts. We just started doing it that way and it stuck!

The reason for using Starling, Monzo, and Revolut is because they don’t charge any fees for using your card abroad. Keep this in mind when choosing which bank accounts you use.

How we work out our budget-

Rather than work out our budget per month, we do it for each country we visit. For example, we are currently spending 2 months in Thailand but when we visited Laos we were only there for 3 weeks. This means the amount of money we need in the accounts will be different.

To work out general daily spends it is £25 x by the number of days we are in a country.

It is exactly the same calculation for accommodation.

For fees a 30 day month would be £500 in total. So to work out what we need in our fees budget we do £500 divided by 30 days which is £16.66, and then multiply this by the number of days we will be in a country.

Is it hard to stick to the budget?

I would say that it isn’t hard to stick to the budget. We don’t restrict ourselves and there isn’t really anything we haven’t done in order to save money.

We will spend money on excursions we know we’ll enjoy and won’t get the opportunity to do again, we pay to go to the gym most days because it benefits our mental and physical health, and we buy ourselves treats like ice creams and smoothies regularly.

Some days we will spend over our daily budget, and other days we might not spend much at all. It depends where we are and what we’re up to. We have found that the budget usually balances out.

Although it is important to properly budget your money in order to get the most out of it, don’t restrict yourself. There is no point missing out because you’re worried about spending a bit extra. You can make money back, but you won’t get the chance to do certain experiences again.

Leave a comment